For businesses that manage vehicle fleets—whether in logistics, car rental, ride-hailing, or field services—insurance costs and liability risks are significant bottom-line concerns. One increasingly valuable tool in addressing these challenges is the dash cam.

Equipping vehicles with dash cams not only enhances safety and accountability but can also lead to reduced insurance-related expenses, improved claims resolution, and better driver oversight. In this article, we’ll explore how dash cams support B2B operations, what insurers are saying about their use, and how solutions like the SEEWORLD V7 Pro are designed with commercial needs in mind.

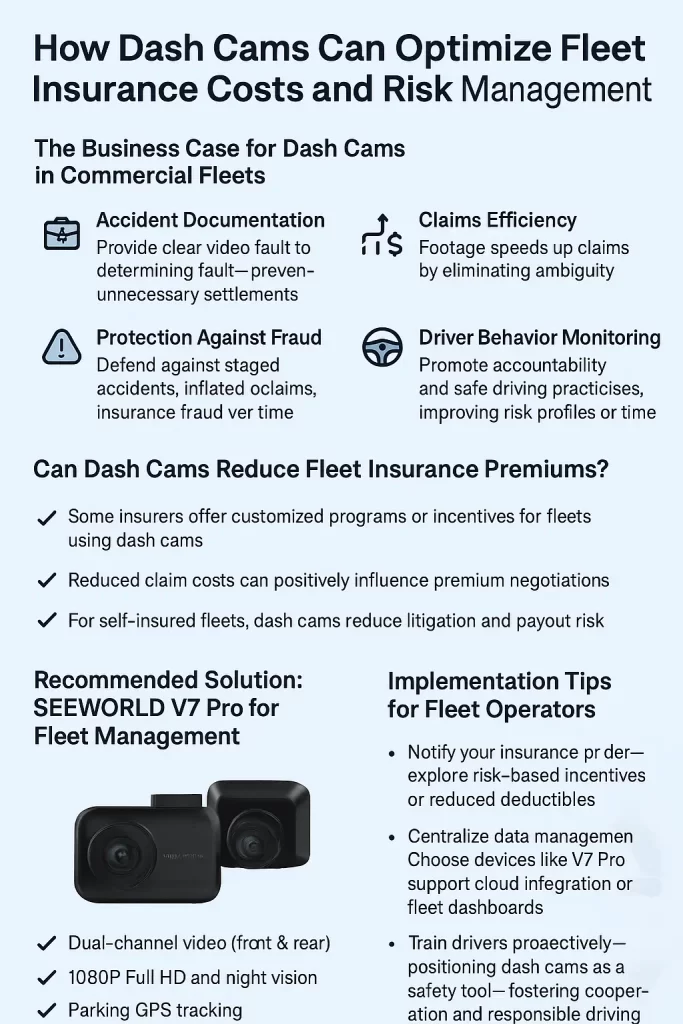

The Business Case for Dash Cams in Commercial Fleets

In high-utilization vehicle operations, the potential for collisions, damage claims, and false liability increases. Dash cams address these risks on multiple fronts:

1. Accident Documentation

Clear video evidence helps establish fault quickly and accurately. In disputed cases, this can prevent unnecessary settlements and shield your business from inflated or fraudulent claims.

2. Claims Efficiency

Dash cam footage accelerates claims processing by eliminating ambiguity. According to data from insurance leaders like Progressive, video evidence can significantly reduce the time (and legal cost) associated with post-accident investigations.

3. Protection Against Fraud

Commercial vehicles are frequent targets for staged accidents. Having recorded footage is a strong defense against insurance fraud, which can otherwise lead to premium hikes and legal exposure.

4. Driver Behavior Monitoring

Dash cams promote accountability and support safe driving practices, especially when combined with performance reviews or safety incentives. Over time, this can improve your fleet’s overall risk profile.

Can Dash Cams Reduce Fleet Insurance Premiums?

While direct discounts vary by provider and region, insurers are increasingly recognizing the risk mitigation value of dash cams:

Some insurers offer customized programs or incentives for fleets using dash cams, especially those integrated into usage-based insurance (UBI) or telematics programs.

Even in the absence of discounts, dash cams reduce total claim costs, which can positively influence premium negotiations during policy renewals.

For self-insured fleets, dash cams directly reduce litigation and payout risk, making them a high-ROI investment.

According to Nexar’s fleet-focused studies, commercial partners who adopted dash cams saw faster claims resolution, reduced false liability cases, and stronger insurer negotiations.

Recommended Solution: SEEWORLD V7 Pro for Fleet Management

The SEEWORLD V7 Pro is engineered with commercial fleet applications in mind. It offers the key features enterprise operations demand:

Dual-channel video (front & rear): Full incident coverage.

1080P Full HD and night vision: Clear evidence under all conditions.

Built-in GPS tracking: Synchronizes footage with location and speed data.

Parking surveillance mode: Records even when the vehicle is parked—essential for rentals or off-hours operations.

Cloud storage option: Centralized data backup for easy claim access or legal review.

V7 Pro 4G dual channel driving dash cam

Whether you manage a small fleet or a nationwide network of vehicles, the V7 Pro supports compliance, safety audits, and claims defense with minimal disruption to your operations.

Implementation Tips for Fleet Operators

To maximize ROI and insurance value from dash cams:

Notify Your Insurance Provider: Share your implementation strategy and explore eligibility for risk-based incentives or reduced deductibles.

Centralized Data Management: Choose devices like the V7 Pro that support cloud integration or fleet dashboards for scalable oversight.

Train Drivers Proactively: Position dash cams as a safety tool, not surveillance, fostering cooperation and responsible driving.

Archive Key Footage: Create SOPs for downloading and backing up footage after incidents.

Conclusion: From Liability Control to Long-Term Savings

Dash cams are no longer optional—they’re strategic. For B2B fleet managers, the operational and financial benefits include faster claim resolutions, lower fraud exposure, better safety compliance, and potential insurance savings.

Solutions like the SEEWORLD V7 Pro provide enterprise-ready features in a cost-effective package, supporting both day-to-day monitoring and long-term risk reduction.

How Dash Cam Improves Fleet Insurance

Interested in Equipping Your Fleet?

Contact our B2B sales team to learn how the SEEWORLD V7 Pro can be integrated into your fleet operations or telematics ecosystem.

Ready to Protect Your Fleet?

The SEEWORLD V7 Pro is built for enterprise-scale use, with smart features that reduce risk and simplify claims. Whether you’re looking to cut costs, improve oversight, or meet insurer requirements, we’re here to help.

Frequently Asked Questions (FAQ)

Not all insurers offer direct discounts, but many recognize the risk mitigation that dash cams provide. Fleets using dash cams can negotiate better premiums over time, especially when they reduce claim frequency or cost. In some cases, insurers offer custom incentives through usage-based insurance (UBI) programs.

Yes, especially when recording audio or in-cabin footage. It’s important to inform drivers about dash cam usage and comply with local laws regarding consent. In many regions, forward-facing dash cams without audio present fewer legal issues.

Most modern dash cams like the SEEWORLD V7 Pro use loop recording and can support up to 128GB microSD cards. For long-term storage or centralized access, we recommend using cloud backup or integrating with a fleet management platform.

Some dash cams offer cloud storage or encrypted file backup, which preserves your footage even if the device is lost. The SEEWORLD V7 Pro can be paired with external storage systems or cloud services to safeguard critical data.

Yes, depending on the dash cam model and your platform. SEEWORLD provides API support and integration options for enterprise clients who want to consolidate video, GPS, and driver behavior data into one dashboard.

For fleets of 10+ vehicles, we recommend scheduling batch installations with a technician or our authorized partners. The V7 Pro supports fast installation and can be configured uniformly across your fleet to reduce setup time.

Absolutely. Its parking mode, rear camera, and tamper-resistant design make it ideal for environments where vehicles are shared or left unattended for long periods. The footage helps resolve customer disputes, damage claims, and liability questions.

ROI comes from several sources: reduced legal expenses, faster claims resolution, fewer fraudulent claims, improved driver behavior, and even fuel efficiency in some cases. Most fleet operators report a positive ROI within 6–12 months of installation.